For instance, maybe your typical $500 grocery bill jumps to $700 in November and December, or you pay your homeowners insurance premium at the beginning of each year.

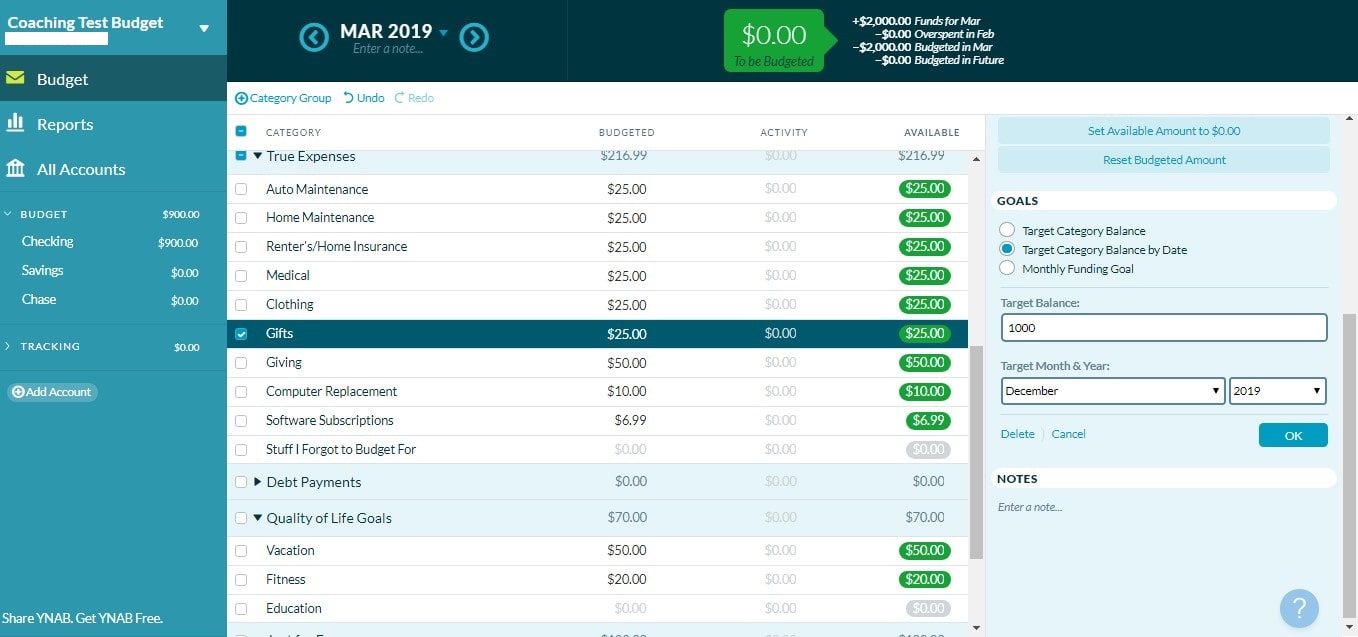

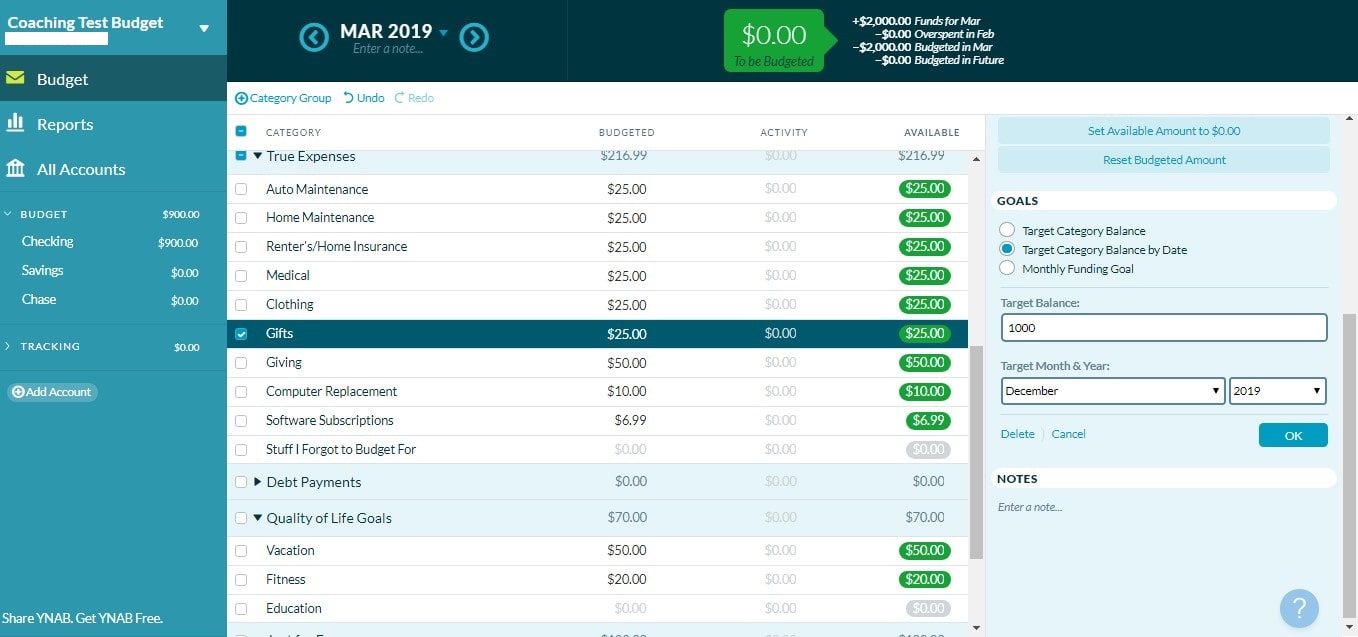

Estimate how much you’ll spend in different categories each month over the next year. Use last year’s pay stubs as a reference point and adjust as needed (perhaps you recently got a raise or finalized a new business deal). Estimate how much you’ll earn each month over the next year. Variable/discretionary ordinary living expenses (such as food, clothing, household expenses, medical payments, and other items for which your monthly spending tends to fluctuate). Fixed costs (such as housing payments, utility bills, charitable contributions, insurance premiums, and loan payments). Separate your spending categories into main buckets. (This is an especially useful exercise if you have uneven income.) For instance, let’s say you spent $500 in January on groceries, which was 12% of your household earnings. Note how much you spent in each category every month, as well as what percentage of your monthly income that spending represented. Categorize all of your expenses over the past year. Add up your take-home pay over the past year. Most institutions let you export your transactions as a CSV file that you can open in Google Sheets, Excel, or Numbers. A year’s worth can give you a good sense of how much you tend to spend over a given period of time. Collect all of your bank and credit card statements over the past year. (Ever get hit with a large bill, such as for an auto repair or emergency dental treatment? Those kinds of things can throw your budget off track.) Spreadsheet-based budgets (and some other budgeting tools) prompt you to create a myriad of categories and assign a dollar amount to each one, which is not only overwhelming but also likely to fail. It tracks your spending, revolving bills, savings goals, and earnings history to estimate how much you have left to spend in a given month in any category you want. We recommend Simplifi for most people because it’s a happy medium between the two. Conversely, zero-balance apps encourage a more hands-on approach, forcing you to account for every dollar you bring in (X amount for savings, Y amount for rent, and so on), but they tend to be idiosyncratic and costly. Tracking apps offer a 30,000-foot view of your finances, display your transactions in real time, and require very little effort to set up. Obviously, this $1000 should be a $1000 outflow on the checking account and a $1000 inflow on the credit card account.There are two basic types of budget apps: trackers ( à la Mint) and zero-balancers. This obviously increases my credit card balance, instead of decreasing it. However, this transaction also shows up under the credit card account as an outflow on the Budget screen.

I enter this as an outflow from my checking account b/c it is money leaving the account and file it under the "credit card" category of my budget. In April, let's say I import my checking account CSV into YNAB and there's a $1000 transfer of funds transaction from my checking to pay my CC balance. I use my checking account to pay my credit card balance. I also have a second issue in that I don't really understand how YNAB manages my credit card transactions. Does anyone know what I'm doing wrong here? Since I have several hundred transactions on this account every month, I don't want to have to manually enter the category for every single transaction I just want YNAB to automatically populate my budget w/ the categories the CSV provides.

Every one of my transactions on the CSV includes a pre-determined Category, however, no matter how I arrange the category on my CSV, whenever I import it to YNAB, the category on the CSV is stuck in the "Memo" column on YNAB's transaction page.

YNAB BUDGETING CREDIT HOW TO

Can anyone offer me a bit of help I'm trying to figure out how to get YNAB to recognize the categories my financial transactions spreadsheet exported from my bank includes (CSV).

0 kommentar(er)

0 kommentar(er)